Navigating Uncertainty: The UK Economy in 2024

The UK economy is facing a crucial year in 2024, as it prepares for a general election amid the aftermath of the Covid pandemic, the energy crisis, and the Brexit transition. While the UK has shown some resilience and recovery in the past two years, it still faces significant challenges and uncertainties in the near future. How will the UK economy compare to other countries in 2024, and what are the main factors that will shape its performance and prospects?

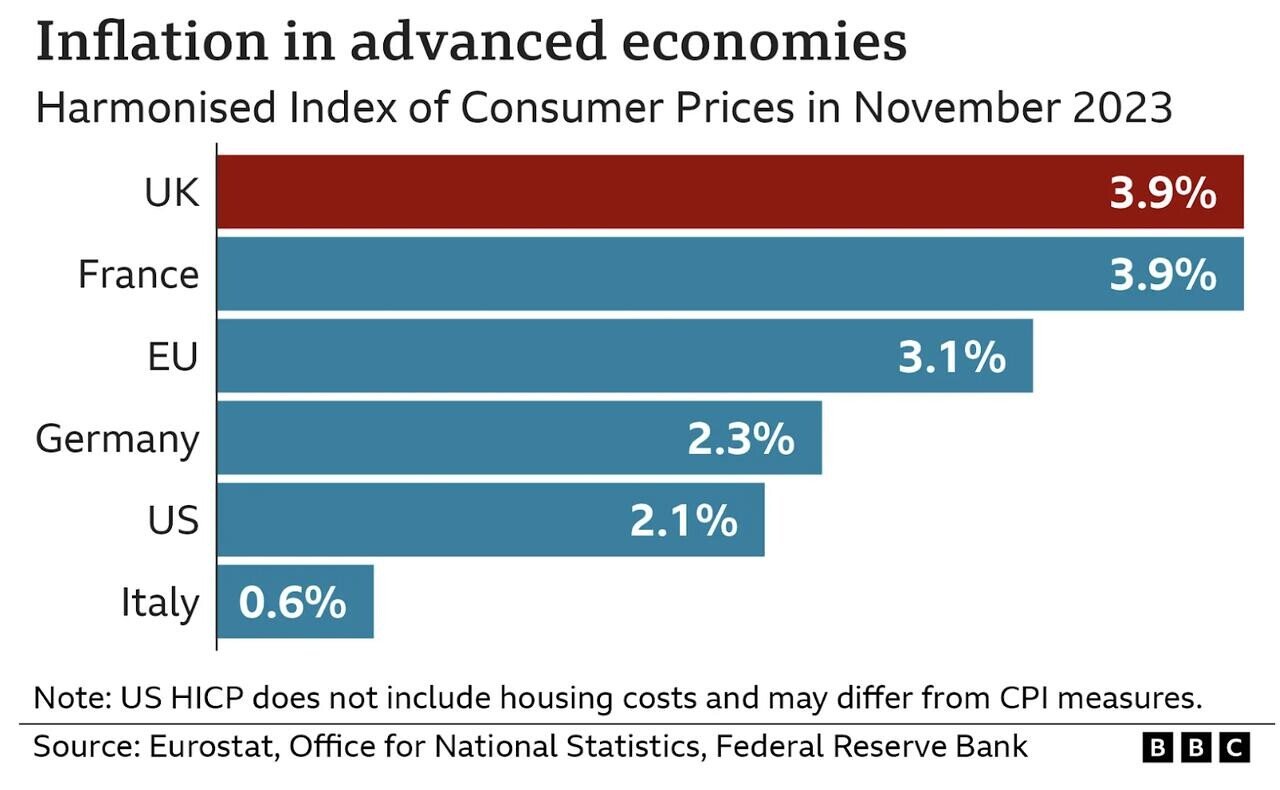

One of the most pressing issues for the UK economy in 2024 is inflation, which has been persistently above the Bank of England’s 2% target since 2022. In November 2023, inflation reached 3.9%, the same as France but higher than the EU average of 3.1% and the US rate of 2.6%. The UK’s high inflation rate has been driven by a combination of factors, such as the spike in energy and food prices due to the war in Ukraine in 2022, the post-pandemic shortage of workers and supply chain disruptions, and the depreciation of the pound following the Brexit referendum.

The Bank of England has responded to the inflation threat by raising interest rates 14 times since 2022, from 0.1% to 5.25%. This has been the most aggressive monetary tightening among advanced economies, and has had a significant impact on households and businesses. Millions of borrowers have seen their mortgage repayments increase as they renewed their deals, while savers have benefited from higher returns. However, higher interest rates have also dampened consumer spending and business investment, as well as increased the cost of servicing the public debt.

The outlook for inflation and interest rates in 2024 depends on several factors, such as the evolution of the energy market, the labor market, and the exchange rate. The Bank of England expects inflation to fall gradually in 2024, reaching 2.8% by the end of the year. However, there are risks that inflation could remain stubbornly high or even rise further, especially if there are new shocks to the global economy or geopolitical tensions. The Bank has said it is ready to adjust its policy stance as needed, and has not ruled out further rate hikes or cuts depending on the inflation outlook. Some economists and financial markets anticipate that the Bank could start cutting rates as soon as the spring of 2024, if inflation shows signs of easing and growth remains weak.

Another key issue for the UK economy in 2024 is growth, which has slowed to a crawl in recent months. According to the latest official figures, the UK economy contracted by 0.1% in October 2023, the first monthly decline since April 2020. The Bank of England has warned that there is a 50-50 chance of a recession in 2024, and has forecast zero growth for the year as a whole. The main factors behind the weak growth performance are the high-interest rates, the high inflation, the supply chain problems, and the uncertainty over the future trading relationship with the EU.

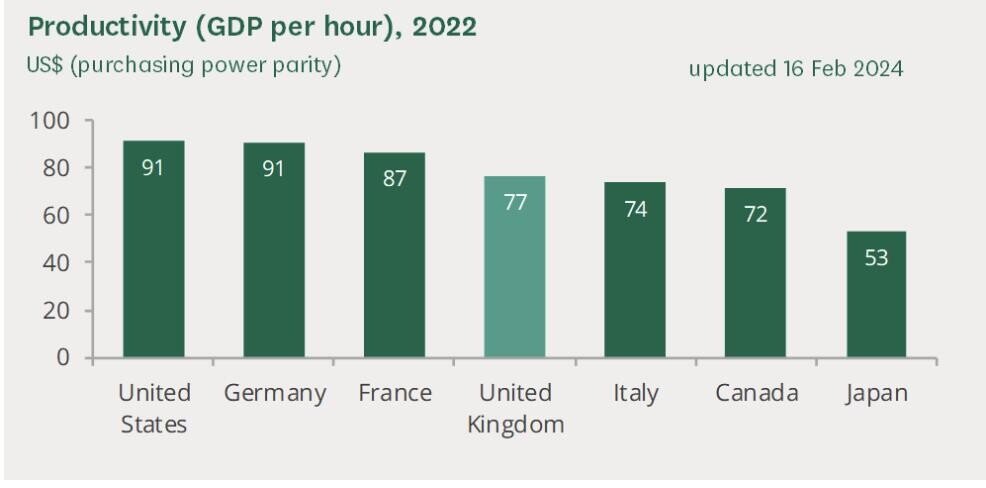

The UK economy has also been hampered by low productivity growth, which has been a long-standing problem since the 2008 financial crisis. Productivity, which measures the amount of output per hour of work, is a key determinant of living standards and competitiveness. The UK’s productivity level is about 20% lower than that of the US, Germany, and France, and has grown at an average annual rate of only 0.3% since 2010. The main reasons for the UK’s productivity gap are the low levels of investment, innovation, skills, and infrastructure, as well as the structural changes in the economy, such as the shift from manufacturing to services and the rise of low-wage sectors.

Source: House of Commons Library, UK Parliament 2024. Productivity of the UK compared to international counterparts according to GDP per hour worked in US Dollars.

The UK government has placed growing the economy and boosting productivity among its top priorities, and has announced several measures to achieve these goals. These include increasing public spending on infrastructure, research and development, education, and health, as well as cutting taxes for businesses and individuals. The government has also launched a new industrial strategy, which aims to support the sectors that have the potential to drive growth and innovation, such as green technology, life sciences, digital, and creative industries. The government hopes that these policies will help the UK economy to recover from the Covid shock, to adapt to the post-Brexit environment, and to seize the opportunities of the global market.

According to the latest forecasts from the International Monetary Fund (IMF), the UK economy is expected to grow by 0.7% in 2024, which is lower than the global average of 3.9% and the advanced economies average of 2.1%. Among the G7 countries, the UK is projected to have the second-lowest growth rate, after Japan (0.5%), and below the US (2.5%), Canada (2.2%), France (1.8%), Germany (1.6%), and Italy (1.1%). The UK is also expected to have the highest inflation rate among the G7 countries, at 2.8%, and the highest interest rate, at 5.25%.

The UK’s economic performance in 2024 will depend largely on how it manages the domestic and external challenges it faces. On the domestic front, the UK will have to deal with the impact of the high interest rates and inflation, the supply chain disruptions, and the uncertainty over the general election and the future trade deal with the EU. On the external front, the UK will have to cope with the global economic slowdown, the geopolitical risks, and the competitive pressures from emerging markets.

However, the UK also has some strengths and opportunities that could help it to overcome these difficulties and to improve its economic prospects. The UK has a flexible and resilient economy, with a diverse and innovative private sector, a skilled and adaptable workforce, and a strong financial system. The UK also has a global outlook and influence, with a leading role in international institutions, a network of trade and investment partners, and a reputation for excellence in science, culture, and education. The UK could leverage these assets to enhance its productivity, competitiveness, and growth potential, as well as to contribute to the global recovery and cooperation.

The UK has set an ambitious target to reach net zero emissions by 2050, and has committed to invest £12 billion in green projects over the next four years. This creates a huge opportunity for innovation and development in renewable energy, low-carbon transport, carbon capture and storage, and other green technologies. The UK is already a global leader in offshore wind, and has the potential to become a hub for hydrogen, nuclear, and electric vehicles. Investing in green technology could not only help the UK to achieve its climate goals, but also to create jobs, boost productivity, and enhance its competitiveness in the global market.

The UK has a world-class reputation for excellence in life sciences, with a strong research base, a vibrant biotech sector, and a leading pharmaceutical industry. The UK has also demonstrated its strength and resilience in responding to the Covid pandemic, developing and producing some of the most effective vaccines and treatments. The UK government has pledged to increase public spending on research and development to 2.4% of GDP by 2027, and has launched a new life sciences vision to support the sector’s growth and innovation. Investing in life sciences could enable the UK to capitalise on its scientific achievements, to improve public health, and to capture a larger share of the global market.

The UK has a dynamic and diverse digital and creative sector, spanning from software and e-commerce to film and music. The UK is home to some of the most successful tech companies in the world, such as ARM, Deliveroo, and Revolut, as well as some of the most popular cultural exports, such as Harry Potter, James Bond, and Adele. The UK’s digital and creative industries have shown remarkable resilience and adaptability during the Covid crisis, shifting to online platforms and finding new ways to engage audiences. The UK government has launched a new industrial strategy to support these industries, focusing on skills, infrastructure, and regulation Investing in digital and creative industries could help the UK to harness the power of technology, to foster talent and diversity, and to enhance its soft power and influence.

References:

BBC News. (2023, July 22). How will the UK economy compare to other countries in 2024? https://www.bbc.co.uk/news/business-66269947

Economics Observatory. (2022, July 15). How is the UK economy faring compared with other countries? https://www.economicsobservatory.com/how-is-the-uk-economy-faring-compared-with-other-countries

Full Fact. (2017, May 19). Is the UK the world's 5th or 9th largest economy? https://fullfact.org/economy/uk-worlds-5th-or-9th-largest-economy/

The Guardian. (2023, December 29). Five charts explaining the UK’s economic prospects in 2024. the Guardian. https://www.theguardian.com/business/2023/dec/29/five-charts-explaining-the-uks-economic-prospects-in-2024

House of Commons Library. (2024, February 15). GDP – International Comparisons: Key Economic Indicators. https://commonslibrary.parliament.uk/research-briefings/sn02784/

Zitelmann, R. (2024, February 28). The UK has slipped down a vital economic index – but it’s not too late. Yahoo Finance. https://uk.finance.yahoo.com/news/uk-slipped-down-vital-economic-070000101.html