Navigating Prosperity: The Economic Landscape of the UAE in 2024

The United Arab Emirates stands at the crossroads of tradition and modernity, where ancient desert landscapes meet futuristic skyscrapers. As a global business hub, the UAE has consistently attracted investors, entrepreneurs, and multinational corporations. In this article, we explore the economic prospects and investment opportunities in the UAE, focusing on data from 2023 and projections for 2024.

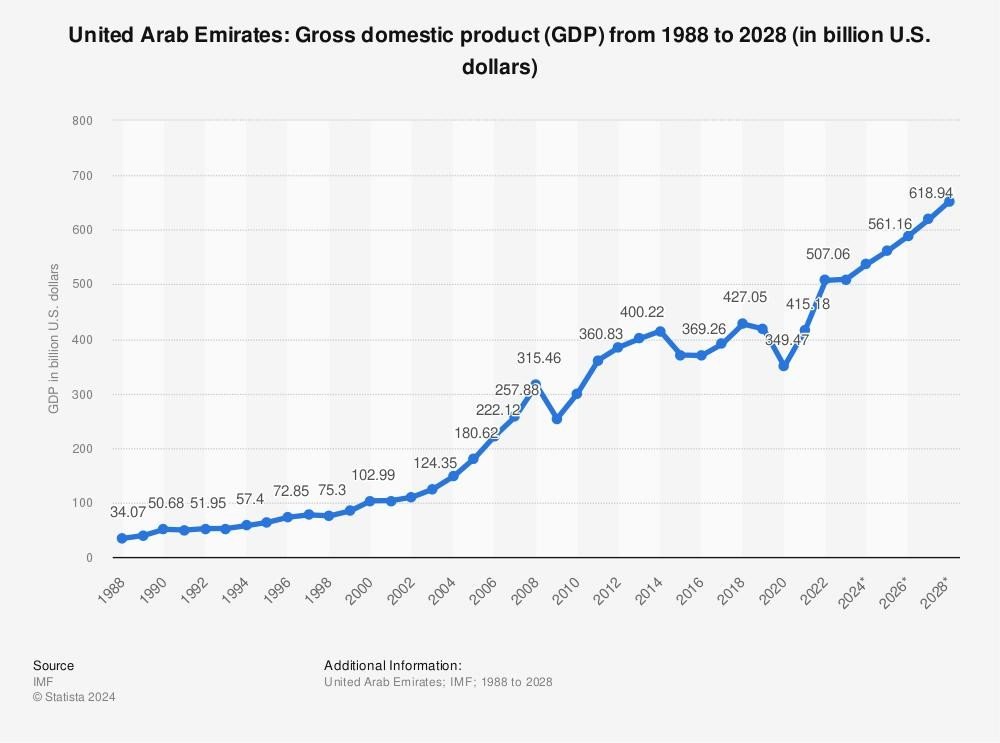

The UAE’s economic resilience remains impressive. Projections indicate that the GDP will grow at a robust rate of 5.7% in 2024. This growth is primarily driven by the non-oil sectors, which are expected to expand by 5.9% in 2023 and maintain a healthy growth rate of 4.7% in 2024. These non-oil sectors include tourism, real estate, finance, and technology. The UAE’s commitment to diversification has paid off, reducing its reliance on oil revenues and fostering a dynamic business environment

UAE Projected GDP, Statista 2024

While the UAE actively diversifies its economy, the oil sector remains pivotal. The country’s prudent fiscal policies and strategic investments in refining, petrochemicals, and renewable energy contribute to overall stability. Despite the global shift toward cleaner energy sources, the UAE continues to leverage its oil resources strategically. The stability of oil prices and the government’s forward-thinking approach ensure a balanced economic landscape.

The UAE consistently ranks high in ease of doing business. Entrepreneurs and investors benefit from streamlined processes for company registration, permits, and licenses. The government actively encourages foreign direct investment (FDI) through incentives, tax breaks, and investor-friendly regulations. Whether you’re a startup founder or a seasoned investor, the UAE’s business-friendly policies create an attractive ecosystem.

UAE Embassy in Washington DC, 2022

The UAE’s commitment to infrastructure development is evident. Ongoing projects, such as Expo 2020, expansion of airports, and port facilities, enhance connectivity and trade. The country’s investment in research centers, smart cities, and digital transformation underscores its determination to lead in innovation and technology. As a result, the UAE remains a fertile ground for tech startups and disruptive ventures.

Tourism and Hospitality: The UAE’s tourism sector has rebounded vigorously. International visitor numbers to Dubai have exceeded pre-pandemic levels, even without the full return of visitors from China. Hotels across the UAE have witnessed rising occupancy levels, with no decline in average daily rates. Abu Dhabi’s hotels, in particular, experienced a substantial 25% year-on-year rise in revenue per available room. The Expo 2020 event and other major attractions continue to drive tourism growth.

The real estate market remains attractive, offering steady returns. Despite challenges, residential and commercial properties continue to draw investors. Construction projects, including infrastructure development and urban expansion, contribute significantly to the non-oil economy. The UAE’s commitment to innovation and technology fuels growth in the manufacturing sector. Investments in research centers, smart cities, and digital transformation position the country as a tech-savvy hub. The manufacturing industry benefits from skilled labor, advanced facilities, and strategic partnerships.

The UAE’s strategic location as a global logistics hub drives growth in this sector. Ports, airports, and efficient supply chains facilitate trade and connectivity. The expansion of transportation infrastructure further enhances the UAE’s competitive edge. The robust banking sector, along with advancements in financial technology (fintech), attracts investors seeking exposure to the region’s financial markets. The UAE actively encourages foreign direct investment (FDI) through incentives and investor-friendly regulations.

In 2023, the UAE achieved a remarkable milestone in FDI, recording a 10% growth and reaching a record high of $22.73 billion. This surge in FDI inflows underscores the country’s attractiveness to global investors. The UAE’s strategic location, business-friendly policies, and diversified economy have positioned it as a preferred destination for foreign capital.

In terms of economic growth, the UAE is expected to see a steady expansion with a projected growth rate of 4% in 2024, largely driven by its non-oil sector. Similarly, Saudi Arabia experienced impressive growth in its non-oil economy, reaching 4.4% in 2023, making it the fastest-growing G20 economy, fueled by private consumption and non-oil private investment. In terms of labor force participation, both the UAE and Saudi Arabia have made significant strides, with female labor force participation reaching 36% in Q1 2023 in both countries, surpassing previous benchmarks. When comparing economic growth with Kuwait, the UAE maintains a slightly higher growth rate, with its non-oil economy expected to grow by 4.5% in 2024, while Kuwait's non-oil sector is projected to grow by 4.4% in 2023.

Looking at the broader GCC region, the UAE stands out with robust non-oil growth projections of 4.4% in 2024, contrasting with the GCC region's estimated growth rate of 1% in 2023, albeit rebounding to 3.6% and 3.7% in 2024 and 2025, respectively, with non-oil sectors playing a pivotal role in sustaining this growth.

As we step into 2024, the UAE’s growth story continues to unfold. Its blend of tradition and innovation, coupled with investor-friendly policies, positions it as a prime destination for business and investment. However, prudent research, risk assessment, and professional advice remain essential for successful investment ventures. The UAE invites you to be part of its dynamic journey toward economic prosperity.

References:

Alhindi, I. (2023, December 29). IMF forecasts UAE GDP growth of 3.4% in 2023 to 4% in 2024. LinkedIn. https://www.linkedin.com/pulse/imf-forecasts-uae-gdp-growth-34-2023-4-2024-ibrahim-alhindi-iwkrf/

Emirates News Agency-WAM. (2023, September 26). UAE economy to grow 3% in 2023; 4% in 2024: S&P. https://wam.ae/en/details/1395303202116

Haque, K. (2024, January 8). UAE: Nonoil growth to remain robust in 2024. Emirates NBD Research. https://www.emiratesnbdresearch.com/en/articles/uaeoutlook2024

Interesse, G. (2024, February 12). UAE Economic Outlook 2024: Resilience, Growth, and Strategic Initiatives. Middle East Briefing. https://www.middleeastbriefing.com/news/uae-economic-outlook-2024-resilience-growth-and-strategic-initiatives/

Multiply Group. (2023, January 4). Economic and market outlook 2023. Multiply Group | Abu Dhabi, UAE. https://multiply.ae/news-insights/insights/economic-and-market-outlook-2023