Latin America and the Caribbean’s Export Dynamics: Opportunities in North America

Latin America and the Caribbean stand as a pivotal force in the realm of global commerce, boasting a diverse array of exports and services encompassing agricultural produce to business process sourcing. With key trade partners such as the United States and China, the region holds a strategic position in international trade. In this article, we will delve into the intricate dynamics of Latin America's export market, shedding light on its primary trading partners and the compelling factors propelling its expansion into the lucrative markets of the United States and Canada. Understanding these dynamics is paramount to understanding the evolving relationship between Latin American exporters and the dynamic North American consumer base.

Latin American countries have traditionally relied on exports of commodities such as oil, minerals, agricultural products, and textiles. According to data from the World Bank in 2021, the main exports from the region have included soybeans, crude oil, automobiles, and coffee, among others. Petroleum oils and oils obtained from bitumen consisted of the largest percentage of Latin America & Caribbean exports, amounting to US$ 55.8 million in 2021. These exports are vital for the economic growth and stability of many Latin American nations. Alongside traditional agricultural exports, the region has been heavily involved in service-based exports such as Business Process Outsourcing (BPO). The Inter-American Development Bank (IDB) has estimated that nearshoring could “add an annual $78 billion in additional exports of goods and services in Latin America and the Caribbean”.

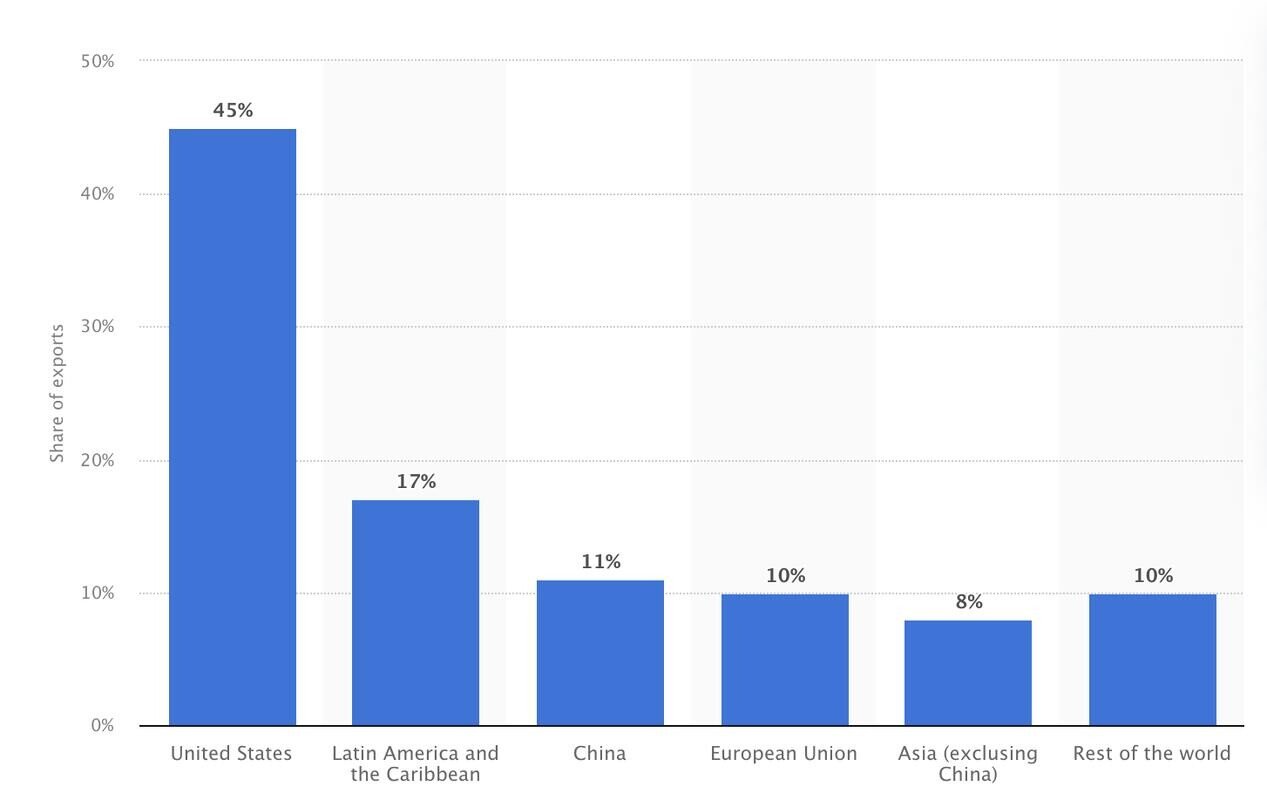

In terms of trading partners, Latin American countries have strong ties with both regional and global economies. The United States and Canada are among the top trading partners for many Latin American countries, accounting for a significant portion of their export markets. Mexico, in particular, sends up to 80% of its exports to the United States, according to the Embassy of Mexico to the United States.

Source: Share of Exports from LATAM Countries to the rest of the world, 2017.

Unsurprisingly, Latin American and Caribbean companies view the US and Canadian markets as highly attractive expansion opportunities. With their large consumer bases and high purchasing power, these markets offer immense potential for growth and profitability. Latin American companies increasingly see North America as a key destination for investment and expansion, driven by factors such as market stability and consumer demand (IDB, 2022).

Trade agreements such as the North American Free Trade Agreement (NAFTA), now United States-Mexico-Canada (USMCA), play a crucial role in facilitating trade between Latin America and North America by reducing tariffs and other trade barriers. According to Brookings, in 2022, the total value of trade within North America (US, Canada, and Mexico) exceeded US$1.5 trillion. These agreements provide Latin American companies with preferential access to the US and Canadian markets, enhancing their competitiveness and enabling them to expand their export opportunities.

Latin American companies offer several unique selling points compared to their North American counterparts. These may include lower production costs, access to unique ingredients or materials, and expertise in certain industries. For example, companies like Grupo Bimbo leverage their extensive distribution networks and economies of scale to compete effectively in the North American market.

Entering the North American market presents Latin American companies with various challenges, including regulatory hurdles, language barriers, and competition from established brands. However, these challenges are accompanied by significant opportunities for growth and expansion. By leveraging their strengths and addressing key market challenges, Latin American companies can position themselves for success in North America. One notable example of a successful Latin American company expanding into the US and Canadian markets is NOTCO, a Chilean food tech startup that manufactures plant-based meat substitutes. NOTCO has effectively leveraged its innovative products and marketing strategies to gain traction in North America, overcoming challenges such as consumer skepticism and competition from established brands.

Looking ahead, the prospects for Latin American companies in the US and Canadian markets are promising. Emerging trends such as the growing demand for sustainable products and the rise of e-commerce present new opportunities for expansion. Innovation will continue to drive competitiveness, with companies investing in research and development to meet evolving consumer preferences. The expansion of Latin American companies into the US and Canadian markets has significant economic implications, including job creation, investment opportunities, and cultural exchange. As these companies establish operations and forge partnerships in North America, they contribute to the growth and diversification of local economies, fostering mutual prosperity. Collaboration and partnerships between Latin American companies and North American businesses, governments, and organizations play a vital role in facilitating trade and fostering mutual growth. By working together to address shared challenges and leverage complementary strengths, companies on both sides of the border can unlock new opportunities for innovation and prosperity.

In conclusion, the expansion of Latin American companies into the US and Canadian markets represents a mutually beneficial opportunity for growth and collaboration. By understanding the dynamics of this evolving relationship and addressing key challenges, Latin American companies can position themselves for success in North America while contributing to the economic and social development of the region.

References:

Brookings. (2023, July 24). USMCA at 3: Reflecting on impact and charting the future. https://www.brookings.edu/articles/usmca-at-3-reflecting-on-impact-and-charting-the-future/

Embassy of Mexico to the United States. (2019, June). U. S. – Mexico Trade and Investment Relationship. Secretaría de Relaciones Exteriores (SRE). https://embamex.sre.gob.mx/eua/images/stories/economicos/tradebystate/US_MX_Trade_and_Investment_Relationship.pdf

Inter-American Development Bank. (2022, June 7). Nearshoring can add annual $78 bln in exports from Latin America and Caribbean. Inter-American Development Bank (IDB). https://www.iadb.org/en/news/nearshoring-can-add-annual-78-bln-exports-latin-america-and-caribbean

Inter-Development Bank (IDB). (2019). Latin America And The Caribbean: Trade Trends Estimates. World Trade Organization - Global trade. https://www.wto.org/english/tratop_e/devel_e/a4t_e/gr19_e/trade_trends_estimates_latin_america_and_the_caribbean_2019_edition_1q_update_en_e.pdf

Inter-Development Bank. (2024, January 30). Decline in exports from Latin America and the Caribbean softens. IDB. https://www.iadb.org/en/news/decline-exports-latin-america-and-caribbean-softens

Statista. (2018, April 12). Latin America exports share by region. https://www.statista.com/statistics/1100160/share-latin-america-exports-main-regions-of-destination/

World Bank. (2021). Latin America & Caribbean trade | WITS | Text. World Integrated Trade Solution (WITS) | Data on Export, Import, Tariff, NTM. https://wits.worldbank.org/CountrySnapshot/en/LCN/textview