A trillion-dollar gamble: Trump’s tariffs, the global sell-off and what the future of trade holds

Just over a week ago, President Trump imposed tariffs on imports at levels not seen since the early 1900s. Since then, stock markets in the US, Asia and Europe have plummeted, based on worries of the consequences they will bring on businesses and economies globally, as well as growing fears of a recession. In the US alone, the market sell-off wiped out almost $10 trillion in wealth (Reuters, 2025). Yesterday, though, the markets started to rebound based solely on the news of the start of trade negotiations with over 50 countries, exposing the willingness of investors to attach themselves to any sign of hope in the face of the US administration’s policy uncertainty. But last week’s effects on global stock markets and currencies have been historic, and worth examining.

What is Trump trying to achieve through tariffs in the first place?

In a blatant move against free trade and in further pursuit of protectionist policies, these tariffs are backed by Trump’s determination to reset trade relations that have for years treated the US ‘unfairly’. This rhetoric, however, understates the magnitude of what, by single-handedly going against the global economic order, he is trying to accomplish for the USA in the long term.

The explanation behind why Trump introduced these tariffs and what he is trying to achieve by doing so, goes back to his MAGA theory, but is actually based on protectionism, an economic theory which is unpopular nowadays given the extent of globalisation and how entrenched free trade is as a global doctrine. By imposing tariffs on foreign imports, which make these goods more expensive for Americans, it disincentivises their purchase and makes them less competitive when compared to domestic products. Doing so aims to grow demand for domestic goods and services, and protects US industries and manufacturers from foreign competition. This would, in the long run, revive America’s industry, which has been devastated after decades of moving towards an almost exclusively service-based economy. Over the years and because of free trade, the US has increasingly relied on cheaper imports of manufactured products produced in other, generally less developed countries, which have specialised in manufacturing as part of their economic growth trajectory towards becoming a developed economy.

Essentially, Trump wants to completely reverse decades of economic development and free trade, in order to revive American manufacturing and industry. Protectionism as a doctrine is also particularly attractive to Trump, not only at a personal ideological level, but politically, since it is the USA’s industrial heartland which overwhelmingly voted for him in 2024.

Wiping out a fifth of wealth in American stock markets in just 3 days is, for the current President, simply a side-effect.

Effects on stock markets, by continent

Although Trump had campaigned incessantly on his plans to implement tariffs, the scope and level are much worse than investors had initially expected. Even after the first days of the sell-off, the President did not backtrack, which led to markets plummeting further. In the past week, traders have also priced in interest cuts by the ECB and Federal Reserve, the increasingly growing risk of a recession and the policy uncertainty concern surrounding tariffs and trade relations (Reuters, 2025).

The response from stock markets has been unanimous, regardless of the continent analysed.

US markets

The announcement that Trump would not back down on his tariffs unless countries evened out their trade with the US, sparked a global sell-off.

Wallstreet lost almost $6 trillion in just two days, and the total amount by the third day of the sell-off was of $9.5 trillion (Reuters, 2025). Major indices opened more than 20% down from their most recent high a mere seven weeks ago (Morrow, 2025). This represents a fifth of the total wealth of US markets at their peak in February of this year.

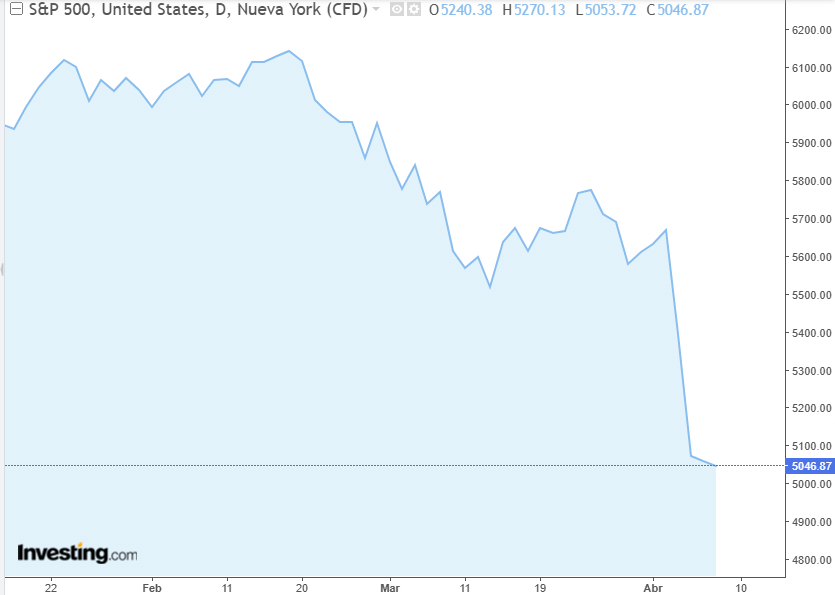

The S&P 500 index price chart from February to today is shown below:

Source: Investing.com

Furthermore, following a tweet on social media that the President was considering a 90-day pause on tariffs on all countries except for China, the S&P, Nasdaq and the Dow went up a staggering 8% in just a few minutes on Monday, just to dip again hours later following an announcement by the White House that that was fake news (Morrow, 2025).

The dollar

The dollar fell by 1.7% in just a day, the largest daily sell-off since November 2022 (Reuters, 2025). In a turn of events, investors who would normally rush to the dollar in times of market uncertainty, ran away from it instead. However, this is extremely unlikely to be a larger sign that the dollar’s standing as the global reserve currency is being undermined, as some have prematurely pointed to. Despite the Trump administration’s upending of free trade and global economic order, there is still no real alternative to the dollar, which remains backed by the biggest economy and capital markets in the world (Reuters, 2025).

European markets

But US stock markets were not the only ones affected. European markets plummeted to their lowest mark in 16 months. Britain’s FTSE 100 index, for example, dove more than 4%, representing its biggest fall since the pandemic (Reuters, 2025).

Pan-European STOXX 600 plunged approximately 6% in early hours of trade on Monday and that same day, the German DAX index fell 6.5%, as one of the hardest hit (Reuters, 2025). The FTSE 100 index at one point on Monday had every single stock in negative territory (Reuters, 2025).

The FTSE 100 index price chart from February to today is shown below:

Source: Investing.com

Asian market

On Monday, Hong Kong’ Hang Seng index dropped more than 13%, its biggest daily fall since 1997. The Shanghai Composite Index was stable yesterday, but losses occurred in Taiwan and Singapore. Thailand and Indonesia’s markets were also down by over 4% and 9%, respectively (Haslett & Edwards, 2025). This was amidst Trump’s declarations that he would refuse to make any deal with China until the US trade deficit was sorted out (Reuters, 2025).

The Hang Seng index price chart from February to today is shown below:

Source: Investing.com

In response to China’s retaliation of 34% counter-tariffs, Trump warned that if China did not remove their retaliatory levy, he would impose an extra 50% tariff (BBC News, 2025). This would amount to an incredulous total tariff of 104% on Chinese imports (Haslett & Edwards, 2025).

Rebound

Yesterday, after days of selloffs, European shares started to recover slightly, although the sentiment is still of caution and sensitivity to how tariff and trade agreements develop in the coming days. FTSE 100 was up 1%, Germany’s DAX up 1.3% and France’s CAC 40 index rose 1.8% (Reuters, 2025).

US stocks also opened higher yesterday with the Dow up 3.6%, the S&P 500 gaining 3.4% and the Nasdaq Composite up 3.76% (CNN, 2025).

Also yesterday, major Asian markets started to stabilise, albeit more slowly (BBC News, 2025). Furthermore, Taiwan announced the activation of a $15 billion stock stabilisation fund to prop up its stock market, fearful of a further tailspin (Reuters, 2025).

These improvements were a response to over 50 countries that reported to have commenced negotiations with the US to try to arrange the lifting of tariffs. Generally, as news trickles out about progress in negotiations with different countries, further rises in the market should be expected, as traders cling onto any indication that there might be an end, pause or de-escalation of this trade war. How long this rebound lasts will depend, as always these days, on what Trump decides.

What this sell-off and tariffs mean for the future

This isn’t the first market sell-off and it certainly won’t be the last. What is different about this one though, is that it was self-induced (Collinson, 2025). While most of the past market crises have been a result of external factors such as wars or a pandemic, this one was created by one man alone. This means that the huge losses in wealth and the increased risk of a recession could have been avoided all together.

In any case, the beginning of trade negotiations with over 50 countries seems to have started the rebound of stock markets yesterday.

However, this bounce back is arguably blind optimism, since Trump has repeated that he will not lift tariffs, and even if he chooses to de-escalate, trade negotiations with countries will not change his erratic methods or his grand scheme of re-industrialising the United States. These will inevitably entail a deep re-structuring of the American economy and a complete upending of trade relations and the global order, most likely through a temporary sacrifice in economic growth- all of which stock markets do not have the long-term vision to accept.

References:

BBC News. (2025, April 8). Trump tariffs live updates . Retrieved from BBC News: https://www.bbc.co.uk/news/live/cp8vyy35g3mt

CNN. (2025, April 8). Rally in US stocks wavers as White House doubles down on tariffs on China. CNN. Retrieved from https://edition.cnn.com/2025/04/08/investing/stock-market-dow-tariffs/index.html

CNN. (2025, April 8). Rally in US stocks wavers as White House doubles down on tariffs on China. CNN. Retrieved from https://edition.cnn.com/2025/04/08/investing/stock-market-dow-tariffs/index.html

Collinson, S. (2025, April 8). Trump's refusal to blink on tariffs raises the risks of an ugly endgame. CNN. Retrieved from https://edition.cnn.com/2025/04/08/politics/trump-tariffs-economists-recession-risk/index.html

Haslett, E., & Edwards, C. (2025, April 7). Trump threatens new 50% tariffs on China. CNN. Retrieved from https://www.bbc.co.uk/news/articles/c8rgkkl7v8lo

Investing.com. (2025). FTSE 100 Live Chart. Retrieved from Investing.com: https://uk.investing.com/indices/uk-100-chart

Investing.com. (2025). Hang Seng Live Chart. Retrieved from Investing.com: https://www.investing.com/indices/hang-sen-40-chart

Investing.com. (2025). S&P 500 (SPX) Live Chart. Retrieved from Investing.com: https://es.investing.com/indices/us-spx-500-chart

Morrow, A. (2025, April 7). The markets just gave Trump an off-ramp. Your move, Mr. President. CNN. Retrieved from https://edition.cnn.com/2025/04/07/business/wall-street-trump-tariff-nightcap/index.html

Reuters. (2025, April 8). European shares bounce back after four days of heavy selling. Reuters. Retrieved from https://www.reuters.com/markets/europe/

Reuters. (2025, April 7). European shares dive to 16-month low on trade war gloom. Reuters. Retrieved from https://www.reuters.com/markets/europe/

Reuters. (2025, April 7). Is the dollar losing its appeal as Trump tariffs hit? Reuters. Retrieved from https://www.reuters.com/markets/europe/

Reuters. (2025, April 7). Market Talk: 'Indiscriminate selloff' is worse than expected. Reuters. Retrieved from https://www.reuters.com/markets/europe/

Reuters. (2025, April 8). Taiwan activates $15 billion stock stabilisation fund after precipitous falls. Reuters. Retrieved from https://www.reuters.com/markets/asia/taiwan-activates-15-billion-stock-stabilisation-fund-after-precipitous-falls-2025-04-08/

Written by Laura Rebollo